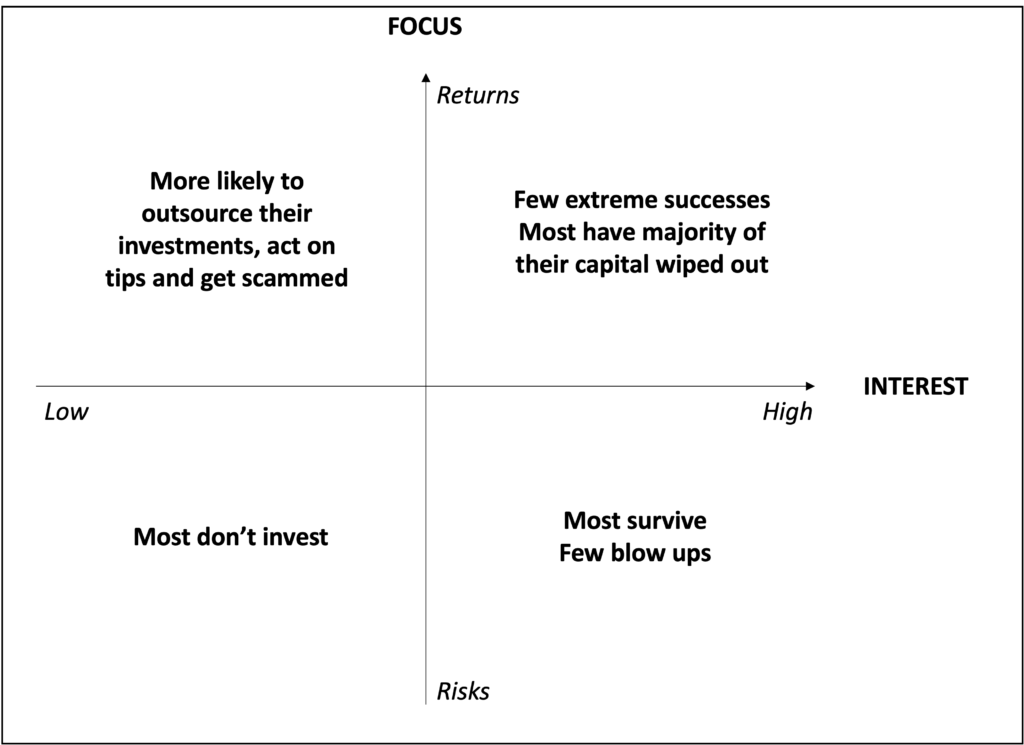

Returns-focused + High Interest. This is the group of investors who are lured by the promise of life-changing returns in the markets (it could be any market – stocks, options, cryptos). They don’t mind getting their hands dirty and get involved in buying, selling and monitoring their investments closely. They try to chase investments with the biggest potential returns at the moment. They believe that they are able to find them and achieve the big wins they so desire and the rewards will be well worth the effort.

Occasionally there will be a few successful examples amplified in the media – “this 20-year old made millions by trading in his pyjamas“. It gives people hope and this group gets inspired to go big or go home with their bets. This mindset caused them to take higher risks. Hence, more investors from this group are likely to end up losing instead of winning big. The losses are huge because of the risks in the types of investment they pursue. These losses are not reported in the media and the survivorship-biased-stats would further motivate more risk takers.

Risk-focused + High Interest. This group are less gung ho – risk is to be respected – it is possible to lose a lot money if not careful. Being careful, they rather not make an investment when the risk is high. They may miss certain opportunities but they are likely to avoid catastrophic losses. This group believes that “there are bold investors but there are no old and bold investors” – risk takers eventually run out of luck.

They understand that there is no guarantee – the markets never promise 100% capital preservation and 20% gain per year. They take a more realistic view and lower their investment expectations. They believe that managing risks are more important than getting big gains – “take care of the downside and the upside will take care of itself” mentality. They are likely to generate moderate returns over a long period of time, thereby enjoying the compounding effect.

The high interest in investing means that they are likely to make investment decision on their own and prefer to have more say over what goes in and out of their portfolio.

Risks-focused + Low Interest. People who are risk-averse and have little interest in investing are often the underinvested group. They believe that investing is risky and they would have preserved their capital by doing nothing. Investing could be daunting to this group as they feel that they don’t understand it well enough and it is too boring to learn. So they end up leaving most of their money in the bank. While their capital is safe, their wealth grows very slowly too, mainly contributed by savings.

Returns-focused + Low Interest. This group believes that investing is a must in order to grow one’s wealth. They believe that working alone is not enough and making money work harder is the smarter way. Everyone will run out of career runway one day and yet life expenses will keep going. Since retirement is inevitable, achieving early retirement is a much better proposition. Some may even be more extreme to think that investment is their only way to riches.

But understanding investment is a daunting task and something that they have no interest in. Hence they may outsource their investments to bankers, financial advisors, roboadvisors or even scammers. This group is the most vulnerable to scammers because it is precisely about big wins with no effort. They are also likely to believe in and act on investment tips instead of making their own decisions. Buying lottery is a favourite endeavour too.