2020 is an unforgettable year and it will definitely go into the history books. Many lives have been lost due to Covid-19 and the rest of us alive should be grateful and we should stay positive to rebuild our world.

I haven’t been reading much this year despite all the lockdowns and having the convenience to work from home. I got busier with the business as I had to cover more functions. But that is probably an excuse. We can always find time. It is a matter of priority. I definitely didn’t put reading as my priority this year. I found myself more restless and my reading interest has waned.

Nonetheless, I have decided on my book of the year. Here is the link for the last year’s if you have missed it.

It was a tussle between The Star Principle by Richard Koch and The Psychology of Money by Morgan Housel.

I believe most people would choose the latter as it was truly a phenomenal book but the former had more direct impact to my life.

Hence, The Star Principle is my book of the year for 2020! (it was published years ago but I determine the winner based on the year I read it)

This is short book and pretty easy to read. Richard Koch was a business consultant with the Boston Consulting Group (BCG) and he learned about the Growth-Share Matrix during his career. BCG no longer uses it but I find it a highly relevant framework to be applied to investing.

Richard Koch went on to use the framework to determine his own angel investments and made a fortune out of it.

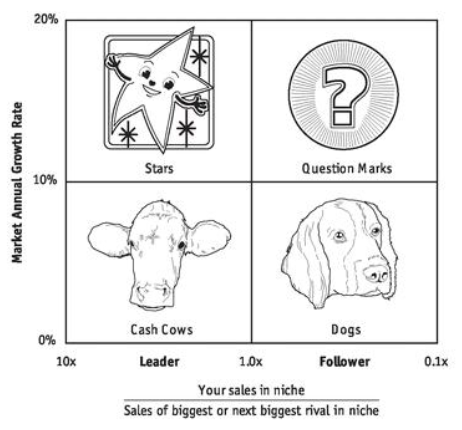

Here’s the BCG Growth Share Matrix:

Basically, you can put the companies you are looking at into one of these four quadrants.

- stars: leaders in high-growth markets;

- question marks: followers in high-growth markets;

- cash cows: leaders in low-growth markets; and

- dogs: followers in low-growth markets.

This is how I have put the concept into practice:

The best growth stocks are the Stars – market leaders with revenue or earnings growing at more than 20% per year. I modified it because it is easier to look at the company and do a comparison with its competitors. The original was referring to the industry that the company was in and the industry needs to grow above 10%. The problem is that the industry growth rate is often an estimate and rarely accurate. One example of Stars is Facebook.

Dividend stocks are the Cash Cows. These are companies that are not growing much but generate loads of cash as market leaders. These are often your blue chip companies. If you are into dividend stocks, Cash Cows are good candidates. One example of Cash Cows is DBS.

The Question Marks are growth stocks but struggling to capture market share from the leaders. Only invest in them if you think they can give the leaders a run of their money in the future. Otherwise, better to avoid especially if the gap has been widening. Think Twitter vs Facebook.

Lastly, Dogs are the most unattractive given their lack of growth and are small players who were outcompeted by bigger competitors. Koch said don’t invest in such businesses. He is right if you are into growth stocks. But there are still opportunities if they are selling at dirt cheap prices, aka deep value stocks. That said, value stocks haven’t been doing well lately and it is important to look for potential catalysts that could unlock value. One example of Dogs is Centurion.

All in all, I find it most useful to identify the Stars – especially to filter away the Question Marks. Because sometimes it is easy to get excited about the growth of a company but only to find out there are competitors with stronger advantages. This framework forces me to map out the competitive landscape and determine who has the best moat.

And I even applied the thinking to cyptocurrencies. The Star is Bitcoin while Ethereum is the Question Mark. Altcoins can perform well from time to time but Bitcoin is going to be a long term winner if cryptocurrency is to be widely accepted by the world. Think about this, which cryptocurrency would most institutions and investors go into first? Likely to be Bitcoin. The mindshare is so strong that Bitcoin is almost synonymous with cryptocurrency. It is the Star.

Remember this is just a framework and there are other considerations before investing in anything. It serves to help me think. I hope you find this useful and try it for yourself. Adopt if it is useful. Discard if it isn’t. Cheers.