(Excerpt from Notes on Charlie Songhurst by Misha Saul)

Boring and Complex

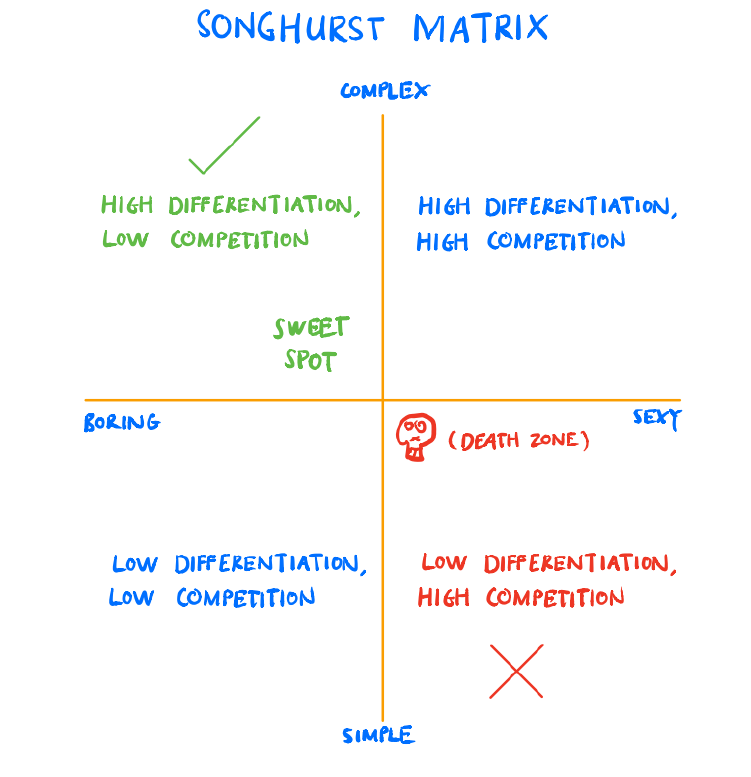

Boring + Complex = low psychological appeal –> low competition –> high potential returns.

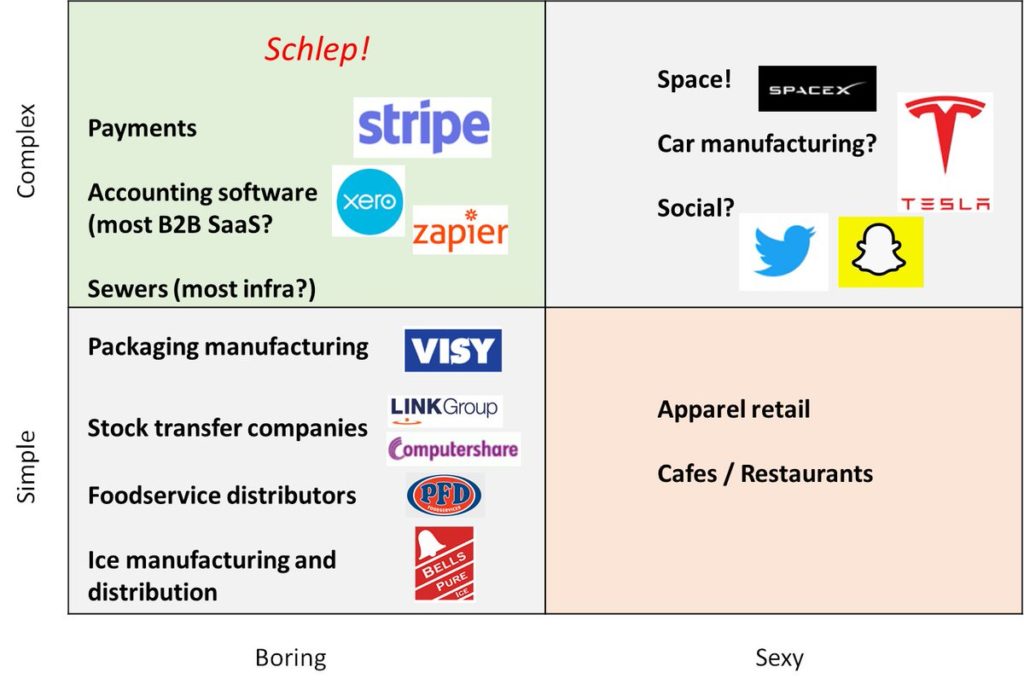

Boring and Complex might also be referred to as a schlep. As in, oy, imagine dealing with financial institutions and regulators and arcane laws and multiple jurisdictions and new tech – what a schlep. Paul Graham coined Schlep Blindness in 2012, which I was reminded of when listening to Songhurst. Graham says this of Stripe:

“Though the idea of fixing payments was right there in plain sight, they never saw it, because their unconscious mind shrank from the complications involved.”

“If you pick an ambitious idea, you’ll have less competition, because everyone else will have been frightened off by the challenges involved.”

Again, like Songhurst, the idea is to bypass competition, to apply filters that uncover overlooked opportunities.

Note the prevalence of infrastructure (digital and physical) in this quadrant. Infrastructure creates enormous utility (…they’re literally called utilities), they’re boring and complex. As platforms, they allow value creation elsewhere. Infrastructure assets are characterised by non-discretionary, predictable cash flows. A troll can charge a toll because you can’t bypass the bridge. In other words, they’re the quintessential monopoly.

Sexy and Simple

Apparel retail and cafes / restaurants are in the last circle of hell, Sexy and Simple, as they are often romanticised by would-be restauranteurs and fashionistas of whom there are many. The sectors are therefore characterised by intense competition such as pitting my Soviet grandma kneading dough in the back against your Indian grandma kneading dough in the back. Zero to One has an extended riff on this point.

Boring and Simple

Just top of mind in a non-exhaustive list, I have selected packaging manufacturing, stock transfer companies, foodservice distributors and an ice manufacturer as examples of Boring and Simple. No one wakes up one day and says “boy, when I grow up I want to make ice cubes” or “I want to build a stock transfer company”. But interestingly, it is in this quadrant that most examples of businesses, and often good businesses, occurred to me. The ones listed are characterised by some mixture of sticky contracts, minimum scale requirements, upfront capital investments, and low margins. These make it hard for new entrants. So in Australia at least these sectors, like many others, have settled on duopolistic market structures. Ice manufacturing is almost too beautiful a business if you can have it.

So maybe this is a fantastic quadrant to be in if you are a founder / existing shareholder of already entrenched firms and you have grown into / inherited the embedded capital costs and market positions. But as a new investor, the simplicity of these models reduces the opportunity for alpha, as everyone longs to make and deliver ice (maybe Simple is Sexy?).

These are also only the winners you see. Maybe if you map the durability of success, it would follow the same ranking. So Boring and Complex businesses tend to endure. Sexy and Complex and Boring and Simple firms have fewer durable advantages and those quadrants are littered with dead bodies we can’t see. And Simple and Sexy firms tend to have the lowest lifespans, highest firm churn and least durability: the business world’s Eastern Front.

Sexy and Complex

Lastly, Sexy and Complex. Well, as Peter Thiel said: Never Bet Against Elon Musk.

I’ve also included consumer social apps in this quadrant. The obvious rejoinder is that, actually, these social media apps and each of Musk’s businesses are worth US$20 – 300bn. Not bad for a suboptimal quadrant. But of course, again, we’re only seeing the successes and not the failures. Tesla is the first US car manufacturer to go public in ~70 years. Consumer social is on the nose with investors because who wants to take on the Facebook empire today? (Maybe that means it’s exactly the right time to take it on….)

And the FAAMGs (Facebook, Amazon, Apple, Microsoft and Google) are in a league of their own.